Are you thinking about investing in Ahmedabad's residential real estate market? Whether you're a first-time homebuyer or a seasoned investor, there are some key factors to consider to make sure a successful purchase. In this comprehensive guide, we will provide you with valuable insights into the Ahmedabad real estate market and equip you with essential tips to navigate the buying process. From determining your budget and hiring a reputable real estate agent to inspecting the property thoroughly and understanding the legal aspects, we've got you covered. So, sit back, relax, and let's embark on this exciting journey of investing in Ahmedabad residential projects. Top Recommended Areas for First-Time Ahmedabad Home-buyers

Ahmedabad's residential real estate market: an overview

Ahmedabad's residential real estate market has witnessed a remarkable surge in recent years, with a plethora of new projects gracing the cityscape. Reputable builders and developers have spearheaded this growth, providing homebuyers with an array of enticing options. From affordable apartments that cater to the budget-conscious to opulent villas that exude luxury, Ahmedabad's real estate market offers something for everyone. This diversity makes the city an ideal destination for first-time homebuyers seeking a worthwhile investment.

Ahmedabad's strategic location further enhances its appeal. The city boasts excellent connectivity to other major metropolises in India, making it an attractive proposition for those considering relocation or exploring opportunities for rental income. The thriving IT industry and the burgeoning business landscape have also contributed to the escalating demand for residential properties in Ahmedabad. This confluence of factors presents investors with a lucrative opportunity to capitalize on the city's real estate potential.

Top Recommended Areas for First-Time Ahmedabad Home-buyers

Ahmedabad offers diverse neighborhoods that meet the preferences and needs of first-time home buyers. Here are some of the top recommended areas for first-time homebuyers in Ahmedabad:

1. Amblir: Bopal-amble is a popular residential area located in the heart of Ahmedabad. It offers a mix of modern and traditional properties, ranging from affordable apartments to luxurious villas. The area is well-connected to various parts of the city and is known for its excellent social infrastructure, including schools, hospitals, shopping centers, and restaurants.

2. Satellite: Satellite is another sought-after residential area situated in the western part of Ahmedabad. It is known for its well-developed infrastructure, wide roads, and serene environment. Satellite offers a variety of housing options, including apartments, bungalows, and row houses, catering to different budgets and preferences. The area is home to several educational institutions, healthcare facilities, and recreational centers.

3. Bodakdev: Bodakdev is a premium residential area located in the eastern part of Ahmedabad. It is renowned for its luxurious bungalows and high-end apartments. Bodakdev is a preferred choice for those seeking a sophisticated living experience. The area boasts excellent connectivity, lush green surroundings, and proximity to prominent business hubs, shopping malls, and fine-dining restaurants.

4. Jagatpur: Jagatpur is a rapidly developing residential area in the western part of Ahmedabad. It is known for its affordable housing options, making it a popular choice for first-time homebuyers. Vastrapur offers a range of properties, including apartments, row houses, and independent houses. The area is well-connected to other parts of the city and provides access to various amenities such as schools, hospitals, and shopping centers.

5. Thaltej: Thaltej is a peaceful residential area located in the southern part of Ahmedabad. It offers a tranquil environment, surrounded by lush greenery and wide roads. Thaltej is known for its spacious bungalows and modern apartments. The area is well-connected to other parts of the city and provides access to several educational institutions, healthcare facilities, and recreational centers.

6. Science City Road: Science City Road is a rapidly growing residential area located in the eastern part of Ahmedabad. It is known for its affordability and offers a variety of housing options, including apartments, row houses, and independent houses. Science City Road is well-connected to other parts of the city and provides access to various amenities such as schools, hospitals, and shopping centers.

Tips for First-Time Ahmedabad Home-buyers

When buying a property in Ahmedabad for the first time, it's crucial to consider the long-term potential of the area. While a home may seem affordable now, its value can greatly appreciate over time, especially in a rapidly developing city like Ahmedabad. Therefore, it's wise to invest in an area that shows promise for growth, guaranteeing a higher return on investment in the future.

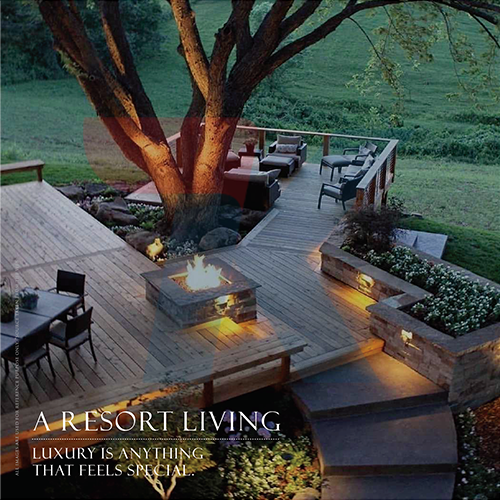

Another important tip for first-time home buyers is opting for a home that suits their lifestyle and preferences. Ahmedabad offers a diverse range of residential projects, from luxurious apartments to spacious villas and independent houses. Consider factors such as the number of bedrooms and bathrooms, the presence of amenities like a gym or swimming pool, and the proximity to schools, hospitals, and shopping centers. Choosing a home that aligns with your lifestyle will protect your comfort and satisfaction in the long run.

Finally, it's essential to look for value-added amenities when selecting a residential project in Ahmedabad. Many modern projects offer features that enhance the quality of living, such as 24/7 security, power backup, rainwater harvesting, and landscaped gardens. These amenities not only provide convenience but also contribute to the overall value and appeal of the property.

By following these tips and conducting thorough research, first-time home buyers can make informed decisions when investing in Ahmedabad residential projects. With its strong growth potential, diverse housing options, and value-added amenities, Ahmedabad presents an excellent opportunity for those seeking a worthwhile real estate investment.

Determine your budget

When embarking on the exciting journey of purchasing your first home, it is crucial to carefully determine your budget. This will serve as a guiding framework for your home search and ensure that you make informed financial decisions.

To begin, you should calculate the loan amount you can comfortably afford. This involves assessing your income, debts, and monthly expenses. It is advisable to use a mortgage calculator to determine the maximum loan amount that aligns with your financial situation. Keep in mind that the monthly mortgage payment typically includes principal, interest, taxes, and insurance (PITI).

Next, you need to consider the down payment. This is the initial payment you make towards the purchase of your home, and it typically ranges from 3% to 20% of the purchase price. A larger down payment can reduce your monthly mortgage payments and the total interest you pay over the life of the loan.

In addition to the down payment, you should also factor in closing costs. These are one-time fees associated with buying a home, such as appraisal fees, loan origination fees, title insurance, and inspection fees. Closing costs can vary depending on the location and the purchase price of the home, but they typically range from 2% to 5% of the purchase price.

Finally, it is important to account for ongoing expenses when determining your budget. These include monthly utility bills, property taxes, homeowner's insurance, and maintenance costs. It is crucial to realistically estimate these expenses to make sure that you can comfortably afford the ongoing costs of homeownership.

By carefully considering these factors and determining your budget, you can make informed decisions during your home-buying journey. This will help you find a home that suits your financial situation and lifestyle, ensuring a successful and enjoyable homeownership experience.

Hire A Reputable Real Estate Agent

Hiring a reputable real estate agent is crucial when buying a home in Ahmedabad. A knowledgeable agent can guide you through the process, ensuring a smooth and successful transaction. Here are key factors to consider when selecting an agent:

1. Experience in Ahmedabad Real Estate Market: Choose an agent with extensive experience in Ahmedabad's real estate market. They should possess in-depth knowledge of local neighborhoods, property values, and market trends. This expertise will be invaluable in helping you find the right property at the right price.

2. References from Past Clients: Request references from the agent's past clients. Speak with these individuals to understand their experiences working with the agent. Positive feedback from previous clients serves as a testament to the agent's professionalism, reliability, and effectiveness.

3. Interview Multiple Agents: Don't settle for the first agent you meet. Interview several agents to assess their qualifications, communication style, and approach to real estate transactions. This will allow you to make an informed decision and select an agent who aligns with your needs and preferences.

4. Ensure License and Registration: Verify that the agent is licensed and registered with the appropriate real estate regulatory authority in Ahmedabad. This ensures that they are legally authorized to practice real estate and adhere to ethical standards.

5. Clear Communication and Responsiveness: Effective communication is vital throughout the home-buying process. Choose an agent who is responsive to your inquiries, communicates clearly, and keeps you updated on the progress of your transaction.

6. Negotiation Skills: A skilled agent should possess strong negotiation abilities to make sure that you get the best possible deal on your residential property purchase. Their expertise in negotiating contracts and dealing with sellers can save you time, money, and stress.

By hiring a reputable real estate agent in Ahmedabad, you can benefit from their expertise, guidance, and support throughout the home-buying journey. Their knowledge of the local market, negotiation skills, and commitment to your best interests will greatly enhance your chances of making a successful real estate investment.

Get pre-approved for a loan

Getting pre-approved for a loan is a crucial step in the home-buying process. It involves submitting your financial information to a lender, who will then assess your creditworthiness and determine the maximum loan amount you can borrow. There are several reasons why getting pre-approved is important:

1. Strengthens Your Offer: A pre-approval letter demonstrates to sellers that you are a serious buyer with the financial capability to purchase the property. This can give you a competitive edge over other buyers, especially in a competitive market.

2. Avoids Wasting Time: Pre-approval helps you narrow down your home search to properties within your budget. This saves you time and effort by eliminating homes that you cannot afford.

3. Improves Negotiation Position: Knowing your pre-approved loan amount gives you more confidence during negotiations with sellers. You can make informed offers and negotiate from a position of strength.

4. Expedites the Closing Process: Getting pre-approved can speed up the closing process once you find a home you want to buy. The lender has already reviewed your financial information, so they can quickly move forward with the loan approval process.

5. Compares Interest Rates: Pre-approval allows you to compare interest rates from multiple lenders. This enables you to secure the best possible financing terms for your home purchase.

To get pre-approved, you will need to provide the lender with various documents, including pay stubs, bank statements, tax returns, and proof of employment. The lender will review these documents to assess your income, debts, and credit history. Based on this information, they will determine your creditworthiness and provide you with a pre-approval letter.

Getting pre-approved for a loan is a smart financial move that can benefit you in many ways. It strengthens your offer, helps you avoid wasting time, improves your negotiation position, expedites the closing process, and allows you to compare interest rates. By taking this important step, you can increase your chances of success in the competitive Ahmedabad real estate market.

Consider proximity to public transportation

Proximity to public transportation is an important factor to consider when buying a home in Ahmedabad. Living near public transportation can provide numerous benefits, including convenience, cost savings, reduced environmental impact, and improved access to various parts of the city.

Commuting by public transportation can save you both time and money. By avoiding the hassle of traffic congestion and parking, you can save valuable time each day. This can be especially beneficial for those who work or study in different parts of the city. Additionally, public transportation can be more economical than owning and maintaining a vehicle, as you eliminate the need for fuel, insurance, and maintenance costs.

Living near public transportation also reduces your carbon footprint and contributes to a more sustainable lifestyle. By using public transportation instead of driving, you reduce greenhouse gas emissions and help improve air quality. This is particularly relevant in a city like Ahmedabad, which is working towards reducing pollution and promoting sustainable urban development.

Furthermore, choosing a home close to public transportation provides you with greater access to various parts of the city. This can enhance your social and recreational opportunities, as you can easily explore different neighborhoods, visit landmarks, and attend events without the need for a car. Convenient access to public transportation can also make it easier for friends and family to visit you, fostering stronger connections and a more vibrant community.

When selecting a home in Ahmedabad, consider the frequency and reliability of public transportation options in the area. Research the availability of bus routes, metro stations, or other forms of public transportation near your potential home. Look for areas that have well-established public transportation networks and ensure that the services align with your commuting needs. Additionally, consider the safety and security of the public transportation system in the area, especially if you plan to use it during late hours or in less familiar neighborhoods.

Understand the legalities

When buying a property in Ahmedabad, it is crucial to understand the legal aspects involved to ensure a smooth and secure transaction. Here are some key legal considerations to keep in mind:

Property Title Deed: Before finalizing the purchase, thoroughly examine the property's title deed to verify ownership and ensure there are no disputes or encumbrances. The title deed should be clear and free from any legal complications to safeguard your ownership rights.

Legal Due Diligence: Conduct thorough legal due diligence to uncover any potential legal issues related to the property. This involves verifying the property's zoning regulations, building permits, and any ongoing or pending legal disputes. Ensure that the property complies with all applicable laws and regulations to avoid future complications.

Sale Agreement: The sale agreement is a legally binding contract between the buyer and seller, outlining the terms and conditions of the property sale. Carefully review the agreement, paying close attention to details such as the purchase price, payment terms, possession date, and any contingencies. Seek legal advice if necessary to ensure your rights and interests are protected.

Property Transfer Process: Understand the legal procedures involved in transferring the property ownership from the seller to you. This includes completing the necessary paperwork, paying stamp duty and registration fees, and obtaining the required approvals from relevant authorities. Ensure that all legal formalities are completed accurately to secure your ownership rights.

Tax Implications: Consider the tax implications associated with buying a property in Ahmedabad. This includes understanding the Goods and Services Tax (GST) and stamp duty applicable to the transaction. Consult with a tax advisor to ensure compliance with all tax obligations and to optimize your tax liability.

Legal Representation: Given the complexities of real estate transactions, it is advisable to seek legal representation from an experienced real estate attorney. They can guide you through the legal process, ensuring that your rights are protected and that the transaction is conducted smoothly and legally.

Inspect the property thoroughly

Inspecting a property thoroughly before purchasing it is crucial to ensure that you are making a well-informed investment. Here are some key aspects to consider during your property inspection:

Begin by examining the foundation of the property for any visible cracks or signs of settling. Cracks in the foundation can indicate structural issues that may require costly repairs. Pay attention to the condition of the roof, checking for any leaks, missing or damaged shingles, or signs of water damage. A damaged roof can lead to water infiltration and subsequent interior damage.

Next, inspect the plumbing and electrical systems. Check for any leaks or clogs in the plumbing system, and ensure that the water pressure is adequate. Examine the electrical system for any exposed wires, faulty outlets, or flickering lights. These issues can pose safety hazards and may require immediate attention.

Look for signs of pests, such as droppings, nests, or damage to the property. Pest infestations can be a nuisance and may require professional treatment and prevention measures.

Evaluate the overall condition of the property, including the interior and exterior paint, flooring, walls, and ceilings. Check for any signs of water damage, mold, or mildew, which may indicate underlying issues that need to be addressed.

Consider the functionality and condition of the appliances included in the property. Test all appliances, including the stove, oven, refrigerator, dishwasher, and washing machine, to ensure they are in working order.

Finally, assess the property's curb appeal and landscaping. Consider whether the property's exterior is well-maintained and if the landscaping enhances the overall appearance.

By conducting a thorough inspection, you can identify any potential issues with the property and make informed decisions about whether to proceed with the purchase. It is recommended to involve a professional home inspector to assist with the inspection process and provide a comprehensive report of the property's condition.

Plan for additional costs

When buying a home, it is essential to factor in additional costs beyond the purchase price. These costs, if overlooked, can strain your budget and lead to financial difficulties. Here are some key additional costs to consider:

1. Stamp Duty and Registration Fees:

Stamp duty and registration fees are mandatory charges levied by the government when a property is purchased. The stamp duty varies depending on the state and the property value. These fees can be significant and must be paid within a specific timeframe to avoid penalties.

2. Legal Fees:

Involving a legal expert is crucial when buying a property. Legal fees cover the services of a real estate attorney or conveyancer who will review the property documents, conduct legal due diligence, and assist in the preparation and execution of legal documents related to the property transfer.

3. Brokerage Fees:

If you are using the services of a real estate agent or broker, you will likely need to pay a brokerage fee. This fee is a commission based on a percentage of the property's sale price and is paid to the agent for facilitating the transaction.

4. Moving Expenses:

Relocating to a new home involves moving your belongings. Moving expenses can include hiring a moving company, packing materials, transportation costs, and temporary storage.

5. Home Insurance:

Protecting your investment with home insurance is essential. Home insurance policies provide coverage for damages or losses caused by events such as natural disasters, theft, or accidents.

6. Maintenance and Repair Costs:

As a homeowner, you will be responsible for the upkeep and maintenance of the property. This can include regular maintenance tasks like cleaning, gardening, and minor repairs. Additionally, there may be unexpected repair costs that arise over time.

7. Property Taxes:

Property taxes are annual charges levied by the local government based on the assessed value of the property. These taxes contribute to funding essential public services like infrastructure, education, and emergency services.

It is crucial to thoroughly research and plan for these additional costs to ensure a smooth and financially sound home-buying experience. By budgeting for these expenses, you can make informed decisions and avoid any unexpected financial burdens associated with property ownership.

Comments

Post a Comment